Nestled in the heart of Silicon Valley, Milpitas, California, is a hidden gem that offers a unique blend of urban vibrancy and natural beauty. People are drawn to this diverse, growing city because of its strategic location, rich culture, and economic opportunities.

If you’re considering buying or selling a home in the area, this article provides a helpful guide on the Milpitas real estate market.

Credit: Image by Des O'Connell | Unsplash

Introduction to Milpitas Real Estate Market 2024

The real estate market of Milpitas comprises one-of-a-kind single-family houses offered at competitive prices ranging from $295K to $10.5M, along with townhomes, multi-family structures, condominium units, apartment buildings, and vacant lots.

Overview of Milpitas

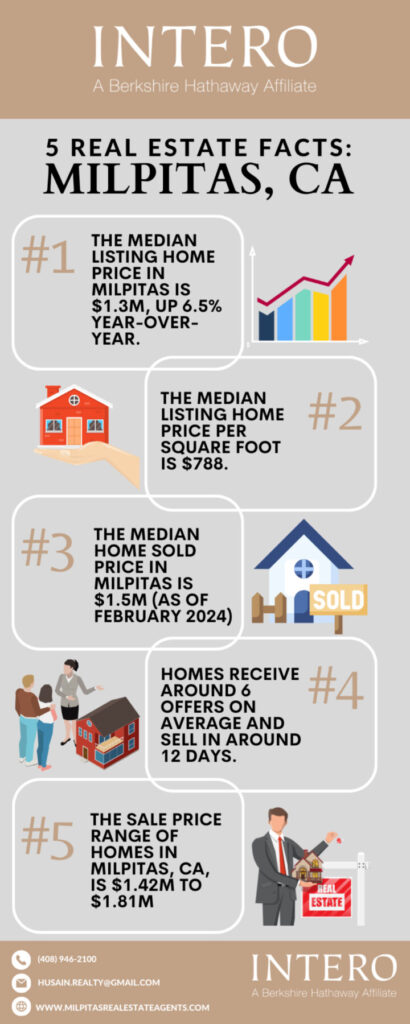

As of February 2024, the Milpitas housing market is a seller’s market, which means that there are more people looking to buy than there are homes available. On average, homes in the area sell after 12 days on the market.

The median listing home price in Milpitas is $1.3M, trending up 6.5% year-over-year. The median listing home price per square foot is $788. The median home sold price is $1.5M. Homes sold for 4.91% above the asking price.

Credit: Image by Towfiqu barbhuiya | Unsplash

Current Trends in Milpitas Real Estate

The Milpitas housing market is very competitive. Homes for sale receive around six offers on average and sell in around 12 days.

Pricing Dynamics

The median sale price of a home in Milpitas is $1.5M last month, a 35.6% increase compared to the previous year. The median sale price per square foot is $872, up 18.5% from last year.

Popular Neighborhoods

| Milpitas CA Neighborhood | Median Home Value |

|---|---|

| Sunny Hills | $1,531,926 |

| Berryessa | $1,556,878 |

| Vineyards-Avalon | $2,982,415 |

| Warm Springs | $1,719,581 |

| East Industrial | $1,221,276 |

| North Valley | $1,212,285 |

| North San Jose | $1,100,781 |

| East Foothills | $1,384,773 |

| Weibel | $2,248,181 |

Credit: Image by Philippe Gauthier | Unsplash

Benefits of Investing in Milpitas Real Estate

Investing in the California real estate market, in general, offers unparalleled opportunities. With its dynamic economy, natural beauty, and rich culture, this location stands out as a prime destination for real estate investors.

Long-term Growth

Milpitas real estate market is characterized by high demand and limited housing inventory, and demand is projected to increase in the following years as the population is expected to reach 113,000 by 2040.

With a growing population paired with attractive job opportunities, there is a rising need for housing across various price points.

The low supply of available residential properties in coveted locations drives up property values, making real estate investments in Milpitas, CA, a smart choice for long-term capital appreciation.

Rental Market Strength

The rental market in Milpitas, CA, appeals to a diverse demographic of tenants, including young professionals, families seeking suburban comfort, and retirees looking for a quiet retreat.

There is a continuous demand for rental properties, making Milpitas a favorable environment for investors seeking steady rental income and lucrative occupancy rates.

The table below shows the average monthly rent per apartment type:

| Apartment Type | Average Rent | Average Size |

|---|---|---|

| Studio | $2,569/month | 572 sq ft |

| One Bedroom | $2,751/month | 716 sq ft |

| Two Bedroom | $3,265/month | 1,004 sq ft |

| Three Bedroom | $3,418/month | 1,242 sq ft |

Credit: Image by Tierra Mallorca | Unsplash

Buyer's Guide: Navigating Milpitas Real Estate

Buying a home in Milpitas, CA, is 3% more expensive compared with the national average.

Considering the median list price of Milpitas homes at $1.3M and a 25% down payment, one would need around $6,963/month to cover expenses. Assuming that’s 35% of your total monthly income, your total yearly income would need to be $238,000.

The table below shows relevant statistics for Milpitas real estate, particularly for single-family homes and condos, to give you an idea of how much you might be paying for your next residence.

| Milpitas Real Estate | Single Family Home | Condo |

|---|---|---|

| Median sale price | $1.81M | $960K |

| Sale price range | $1.42M to $1.81M | $745K to $1.18M |

| Sale price % change in 12 months | 23.12% | 6.18% |

| Median sale price/sq ft | $952 | $780 |

| Sale price/sq ft range | $870 to $979 | $667 to $780 |

| Sale price/sq ft % change in 12 months | 2.84% | 5.55% |

| Median days on market | 7 days | 13 days |

| Days on market range | 7 to 24 days | 7 to 35 days |

| Days on market % change in 12 months | 12.5% | 18.18% |

Financing Options

If you’re a first-time home buyer in Milpitas, there are mortgage options available for you.

Conventional Mortgages

Conventional mortgages are the most common and widely available type of home loan in Milpitas.

These mortgages are not guaranteed or insured by the federal government. They also have higher interest rates than government-backed loans. Some conventional mortgages allow down payments as low as 3%.

FHA Loans

FHA loans are the best option for those with lower credit scores and down payments:

- Borrowers with a credit score of 580 or higher can get a loan with down payments as low as 3.5%.

- Borrowers with scores of 500 and below will need to make a 10% down payment.

FHA loans require mortgage insurance for the life of the loan. You may cancel the insurance if you refinance to a different type of mortgage.

VA Loans

If you are a veteran or the spouse of a veteran, you might be eligible for a VA loan. These loans have very generous terms and conditions, making them an ideal option for first-time home buyers.

VA loans generally have lower interest rates compared to other loans and don’t always require a down payment.

Other Programs

First-time homebuyers in the state of California can take advantage of other loan options from CalHFA:

MyHome Assistance Program

This program assists low-income applicants buy homes through a deferred-payment junior loan of up to 3% of the purchase price or appraised value of the mortgaged property in order to help make the down payment or pay the closing costs.

CalHFA Zero Interest Program

The CalPLUS Conventional or CalPLUS FHA loan can make your mortgage even more affordable, with up to 3% of the total loan amount as a no-interest second loan.

You can defer payments while living in the home, but this must be paid back in full once you sell or refinance.

Conclusion

If you’re in the market to buy a home in Milpitas, you can look forward to an amazing experience choosing among the many beautiful properties in the area!

Allow our team to show you all your best home options in Milpitas. Give us a call today at (408) 946-2100 or send us an email at husain.realty@gmail.com to schedule an appointment.

Frequently Asked Questions

What are the most sought-after neighborhoods in Milpitas for 2024, and why?

Some of the coveted neighborhoods in Milpitas include Sunny Hills, East Foothills, and Vineyards-Avalon because of their beautiful homes, access to plenty of amenities, and peaceful environment.

What tips can you offer for first-time homebuyers in Milpitas in 2024?

Seek the help of an experienced realtor so you can get the best deal out of your real estate transaction in Milpitas.